Recent Posts

Tamil Nadu Shortlists Sites for Greenfield Airport in Hosur

December 25, 2024GST Amendment to Increase Realty Project Costs, Lease Rents

December 25, 2024India’s GDP Growth Slows to 5.4% in Q2 FY25: Hopes on H2 Recovery

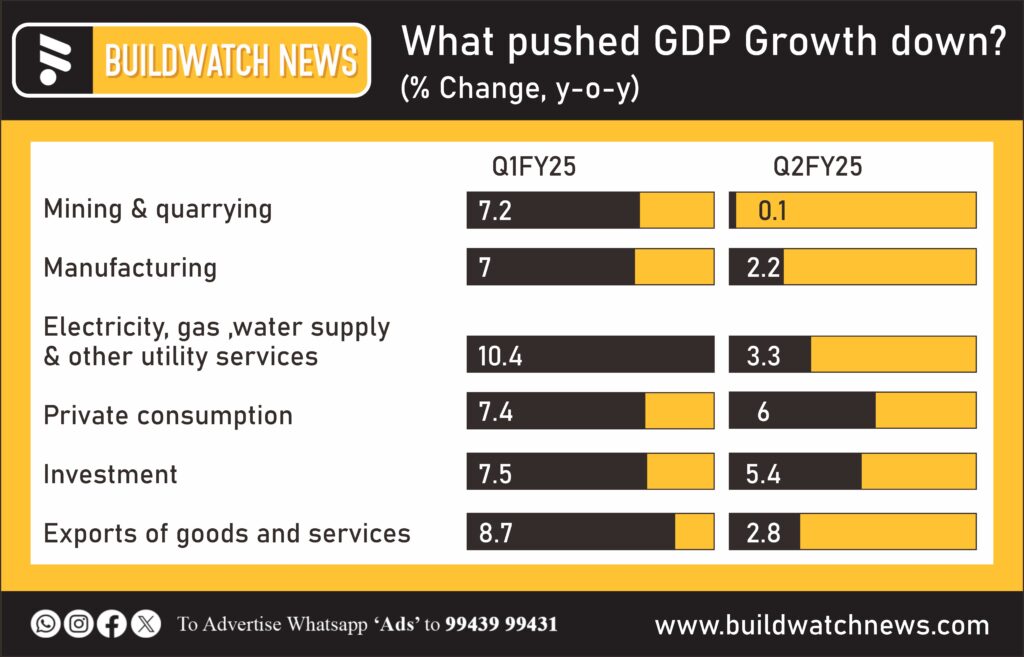

India’s GDP growth dropped to 5.4% in Q2 FY25, its lowest in seven quarters, driven by weak performance in mining, manufacturing, and utilities. Mining contracted for the first time in two years, and manufacturing growth plunged to 2.2% from 7% in Q1. Utilities slowed to 3.3%, down from 10.4%. Private consumption growth also weakened to 6%, while exports fell sharply to 2.8%.

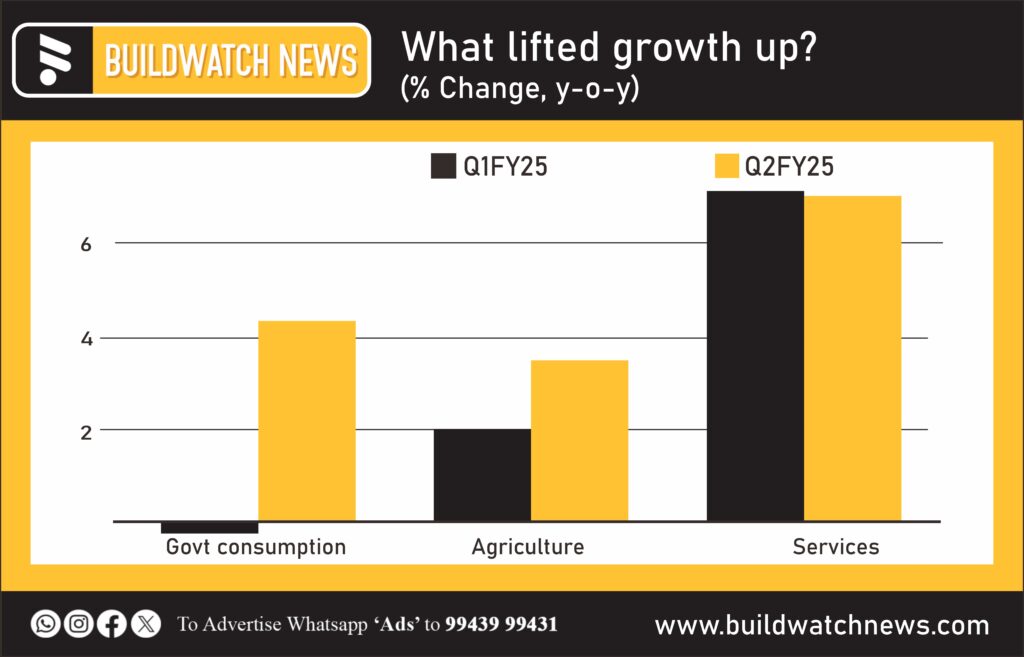

Economists remain cautious but hopeful about H2 FY25. Aditi Nayar of ICRA expects growth to recover, supported by government capex, strong agricultural output, and improved rural consumption. Full-year GDP is projected at 6.5%-6.7%. CareEdge’s Rajani Sinha anticipates government spending and moderating food inflation to bolster consumption in the second half.

Gross fixed capital formation (GFCF) growth hit a six-quarter low of 5.4%, with its share in nominal GDP at a seven-quarter low of 30.8%. However, agriculture showed resilience, growing by 3.5%, while services excluding utilities grew 7.1%, buoyed by trade and hospitality. Government consumption rebounded with 4.4% growth after contracting in Q1.

Experts highlight that private investment is crucial as government capex moderates. Dharmakirti Joshi of Crisil notes, “Private corporate sector needs to step up as the government trims its fiscal deficit.”

RBI faces challenges ahead, with growth figures likely influencing its December policy meeting. The central bank has maintained the policy rate at 6.5% for 10 consecutive sessions, though calls for a rate cut have grown.

India’s economic recovery in H2 hinges on government capex acceleration, inflation control, and private investment growth. The coming quarters will test whether these factors can offset the current slowdown and achieve projected growth.

Recent Posts

RINL Wins Gold Award at AP State Energy Conservation Awards 2024

December 26, 2024Ramky Infrastructure Secures Rs 215 Crore STP Deal

December 26, 2024Cement Industry Optimistic About Growth in 2025 Amid Challenges

December 26, 2024Related Articles

RINL Wins Gold Award at AP State Energy Conservation Awards 2024

“Rashtriya Ispat Nigam Limited has been awarded the `Gold Award’ at the...

ByKanmani ChokkalingamDecember 26, 2024BPCL to Build ₹6,100 Crore Refinery and Petrochemical Complex in Andhra Pradesh

Bharat Petroleum Corporation Ltd. announced its broad development plan for setting up...

ByKanmani ChokkalingamDecember 26, 2024Ramky Infrastructure Secures Rs 215 Crore STP Deal

The share price of Ramky Infrastructure surged by 2.79% to Rs 622.40...

ByKanmani ChokkalingamDecember 26, 2024Cement Industry Optimistic About Growth in 2025 Amid Challenges

New Delhi, Dec 25 (PTI) – Indian Cement Industry is confident of...

ByKanmani ChokkalingamDecember 26, 2024

Leave a comment